Thursday, 22 November 2012

Murphy and that damn petard

Richard is quite right, if you take something away, and then give a bit of it back, then you're not really giving anybody anything. You're taking less away, and should present what you're doing honestly.

And isn't it for exactly that reason that it is exactly as bollocks to refer to tax relief on savings, pensions and investments as a subsidy?

* Of course, if the aim is to cut £3,700m of wasteful expenditure, and £900m is being given back to spend on useful things, then the claim has some merit.. but that's another issue.

Friday, 16 November 2012

On Amazon

If it was tax avoidance by competitors, such as Amazon, that destroyed HMV, and may now destroy John Lewis, doesn't that tell us something about tax incidence?

If tax avoidance gives a competitive advantage... then don't we have to assume that the 'benefit' of it is being passed on to the consumer? And that if the avoidance is stopped, the consumer will be asked to foot the bill in terms of higher prices?

Of course, it is not that simple. There are many differences between a high-street retailer and an internet retailer. Each confers an advantage on one or the other. High-street retailers get immediacy, and no postage costs. Internet retailers get lower storage costs, better consumer data, and the chance to pay tax in Luxembourg. Further, if a company can save £1 on tax, but only needs to give 50p back to the consumer to win the sale, then that is what will happen.

But when all is said and done, these companies operate in competitive and open markets, and the beneficiaries of their lower costs are, first and foremost, the consumers.. for lower costs enable lower prices, and lower prices are what wins the sales in the first place. And where tax dodges are (theoretically, at least) available to all, we should see the market, eventually, price them all in so that the most powerful person in the retail cycle, the consumer, is the one who wins.

Monday, 12 November 2012

Wednesday, 15 August 2012

Thursday, 17 May 2012

Financially illiterate, and colourblind to boot.

Owen Tudor, writing on the Robin Hood tax, informs me that..

Robin Hood Tax campaigners will be out in force around the world and on the web. PCS conference in Brighton next week will see tax collectors and DFID staff donning Sherwood green on the seafront to show their support

As a proud Nottinghamshire boy, this annoys me greatly. Not only have they misappropriated our legend who was, lest we forget, someone who was opposed to silly taxes.. they haven't even got the outfits right. Robin Hood, of course, wore Lincoln green.

Monday, 14 May 2012

On schools...

Various people I like to pay attention to have joined in the fun, and both Shuggy and Chris Dillow quickly come to the conclusion that neither Gove nor Monbiot/Penny have the right answer.

I don't think private school should be banned for a variety of reasons. The main one, I'll admit, is ideological.. I find the idea of the state telling people that they don't have the right to educate their children in the way they deem fit to be rather abhorrent. This is especially so when we're banning parents from educating their children in a way that even the people who would ban it seem to suggest is better than the state system. It's not as if we're even talking about faith schools where one (thought not I) might argue that religious indoctrination of children is a bad thing (I had a Catholic education, as did my siblings and 17 cousins, as did an awful lot of other people I know, and, as yet, none of us have set fire to an abortion clinic even though we ALL saw the requisite video nasty.. indeed, I can't think of a single one of us who would even claim to be anything close to a practicing Catholic).

Another reason why I don't think we should ban private education is that I don't think that banning private education will bring about the desired result. As I commented at Shuggy's place..

These objections also focus far too much on the role of the school in the lives of these children… when anyone with half a brain knows that it's what happens at home that matters the most. Schools, as good as they may be, can only work with what the parents send them. Parents make choices which tell us a lot about how they bring up their children. A parent who wants their child to be privately educated, or even one who will pretend to be a Catholic to get their child into a 'better' state school, is probably a parent who communicates with their children, who supports their children, who pushes their children. It's a parent who is trying to give that child the best possible start. The school is only a part of the system which Monbiot and Penny take issue with.. taking away the school will not change that system.My mother is a Learning Support Worker in my old primary school which, being in a neglected old coal mining community, has steadily deteriorated along with the economy of the area. She'll tell you that you can do what you want with the funding, management and structure of the education system.. you can choose the Tory route or the Labour route, you can model it on the USA, Sweden, China, or the lost civilization of Atlantis if you like.... None of it will make a blind bit of difference if parents will not communicate with or engage with their children at a young age, or if children aged 3 and 4 have to be turned away from pre-school because they are not toilet trained, or if bright kids get bullied by their parents, as well as by their peers.

Friday, 11 May 2012

On Murphy

But, returning to Richard Murphy, unless someone turns up to do his job better than he does it, he's all there is.. and constantly poking him with a stick is achieving nothing. He's not going to change and, indeed, his 'popularity' is increasing and, he very much enjoys the sniping which simply reinforces his view that nothing worthwhile comes from those who would challenge him.

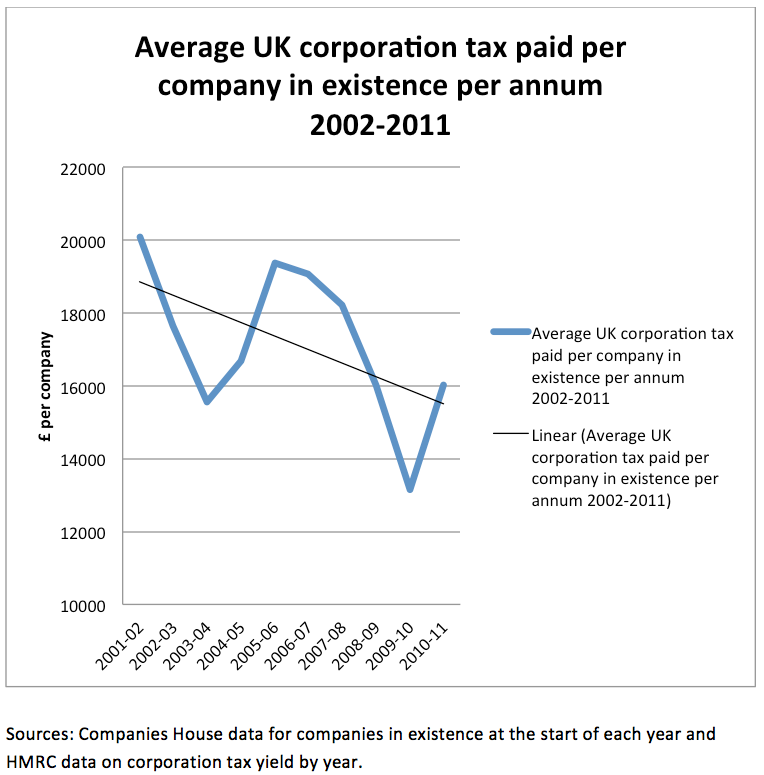

Today he asks us 'Why are companies paying less tax?', and shows us a graph which clearly illustrates that companies are, indeed, paying less tax..

Richard clearly explains what he has done.. he has taken the number of companies in the UK in each year, and the total corporation tax paid, and he's calculated the average paid per company. He's then drawn a line to show the trend.

Or, as the always well-informed Frances Coppola points out in the comments over in Timmyland..

He achieves this remarkable effect by drawing a straight line through two recessions (the second considerably deeper than the first) separated by a boom and followed by the current stagnation.In the comments on his post, Richard explains that there was a large rise in company numbers in 2004, and as he wanted to show a 'before/after' picture he started his line before that (as one of his commentators points out that starting the line in 2003/4 would have it trending upwards). I'm not quite sure why 2001/02 thus becomes the starting point. But let us not get too carried away over this sideshow..

Murhpy, eagerly pre-empting anyone who might wish to trouble him with a critical comment, quickly draws attention to an issue (my emphasis)..

It’s immediately possible to say that of course the amount of tax per company has gone down because the number of companies has gone up, but then so has to proportion of profits in GDP, so that doesn’t quite stack, but I agree I need to do more on that issue.Well, yes. You do. We have an increase of over 1 million companies during the period... or 62%. GDP rose by 42% over the same period, and we have an understanding that there was a spike in incorporations in 2004 due to a (subsequently withdrawn) tax 'fiasco'. That is a huge increase in company numbers, and to assume that the tax profile of those million companies which were added to the register during this period is comparable to that of the 1.6million companies on there at the start, which is what Murphy has done, is farcical... not because it's necessarily untrue (a cursory analysis of table T11.3 in HMRC's corporation tax statistics indicates that the percentage of corporate profits charged at the main and small company rates has not varied a great deal between 2002 and 2010) but because it's wildly premature.

Murphy is eager to point out that 'small companies do pay tax', and he's right... but they pay it at a materially lower rate. He charts a fall in average tax paid (either end of his trend line) from £19,000 to £15,800.. about 17%. The small company tax rate is 25% lower than the main company rate, so a shift in the profile will lower the average rate.

I decided to redraw the graph but adjusted to try and take out two distorting factors..

- A disproportionate growth in the number of companies (measured relative to GDP)

- The fall in the main company tax rate from 30% to 28%

So here's my graph and trendline (the red ones) on top of RM's (the blue ones). I've got the *real* average tax rising. So everything is fine and Richard Murphy is an idiot, yes?

Well, no.. because Richard has shown that you can prove anything by doing a little bit of research, making wild assumptions, and cherry picking what you present. I have proven that you can take data that has been abused to make one point and throw in a couple of plausible sounding assumptions which

make the data say the opposite. And I could easily go further. And I could easily convince anyone pre-disposed to my desired conclusion and lacking the ability/will to question it, that Murphy has no idea what he is talking about and should be forever ignored.

Murphy goes on to discuss his issue with the failure of 700,000 companies a year to submit their corporation tax return. He thinks that this covering up a significant amount of evasion, and that this is a key element of his much-quoted £120bn tax gap(1). I think that anyone who registers a company should comply with HMRC requests for information. If you wish to incorporate, and avail yourself of the legal protections is affords, then it's not a big ask. I think Murphy grossly overestimates the quantum of the tax loss, but that's something of an irrelevance because I agree that something should be done to deal with the problem. It is not acceptable that 30% of companies don't fulfil the modest obligations that parliament has imposed upon them.

And, so, therein lies my big problem.. he's got a point to make, and it's a point I'm happy to see made.. but I don't want to see it made with the aid of such a clumsy tool (I mean the graph, not Richard Murphy), because Murphy's audience will just take the tool and present it as further 'proof' that Phillip Green is the cause of all of our ills. Murphy knows this, he (I am sure) believes that having these misconceptions continually shouted from the rooftops (literally, on occasion) is a good thing, because the benefit of the PR outweighs the harm of an ill-informed populace looking for hate-targets.

I, respectfully, disagree.

(1) As an aside, but which fits with where I find my greatest frustration, Murphy has never suggested that this is something done by large companies and rich individuals.. because he knows that if there is a problem here, then it's the little guys. It's tax evasion, and people who can afford to minimise their tax legally will usually avoid minimising it illegally. However, his £120bn figure is usually attributed by others (UK Uncut, Union leaders etc etc) almost solely to big business and the 1%. I've never seen Murphy attempt to correct this obvious misreading of his own research, which bothers me because if he really wanted tax justice he would want a better understanding of the fact that evasion and avoidance is something which, whatever the quantum, pervades society. If Mark Serwotka, who made this error on Question Time last week really wants that whole £120bn collected, then he needs to be willing to tell the 99% that we, too, need to stump up our share.

Thursday, 10 May 2012

No signal

Gosh no, far better that we cling on to the wildly outdated approach to learning and development that has* served us so well in recent years and is so successful** in engaging and inspiring young minds by staying relevant to the way we live our lives.

* has not

** unsuccessful

Saturday, 21 April 2012

With this invoice I thee wed

Gay people charged 4 times more by the state to 'marry' their partner than religious couples

... says Éoin Clark. And he is right...

Should you wish to mark your commitment and have it sanctioned by Belfast City Council, these are the options (Saturday prices)..

- A civil wedding in the registrars office = £289

- A civil wedding in an 'approved' venue = £273

- A civil wedding in a venue of your choice = £273 + £400 'to apply for a temporary marriage license'

- A Religious wedding = £40

Thursday, 15 March 2012

Progressives, Obsessives and VAT

He talks about the cult of the progressives.. those who shout down any tax/benefit changes they consider aren't wholly designed to bear down disproportionally upon the rich. I (like Christie) believe that a tax system should be progressive, and I don't think I've ever met anyone who doesn't. Deciding what is and isn't progressive because, as Christie alludes, whilst it might seem like science, it's not.

Alas, a complex problem and a complex system is increasingly becoming victim to gross over-simplification for political ends, and the obsession with progressiveness (or, to be more accurate, progressiveness as deemed by the noisier inhabitants of the moderate not-quite-left) is not helping to formulate better and fairer tax policy. Along with this comes the eternal mantra that the tax burden should fall on those with a 'better ability to pay', and by 'better ability to pay' people invariably seem to mean 'with a higher individual gross income'.

Imagine two taxpayers.. Mr £50k and Ms £30k. 'Progressive wisdom' dictates that Mr £50k should pay a higher rate of tax than Ms £30k. If we needed to raise more tax then it would favour increasing income tax, as that would affect Mr £50k more than Ms £30k. 'Progressive wisdom' would not favour an increase in VAT because, it says, that would impact Ms £30k more than Mr £50k, because the increase would account for a greater percentage of her income.

Now let's imagine that Mr £50k is 45 years old, and is a single parent of three, and he has a mortgage on his modest but criminally overpriced 4-bed house. He gets by just fine (£50k is still a good wage) but he's not exactly flash. He spends most of his remaining money on food and clothing for the children, perhaps having some left over to put aside for a rainy day.

Ms £30k is 25, single, living in a flat that her parents paid for. She spend some money on food (lots of meals out and takeaways, mind), drink, entertainment and gadgets.

Now... who's got the better ability to pay a bit more tax? And is an income tax rise or a VAT increase the best option?

This is a deliberately manufactured example, of course... but it's not a stretch to suggest that a lot of people have disposable incomes, which they can spend on the sorts of consumption that VAT taxes, that are much higher than people who have higher earnings.

Income does not always equate to wealth. Income does not always flow through to disposable income. The tax system needs to take account of this. To be 'progressive' it needs to measure 'ability to pay' by reference to more than just earnings. With VAT it does this.. which is why it irks me greatly when VAT is dismissed as 'regressive' all the time, when even in isolation it is not.. and when taken as part of a comprehensive tax system it definitely isn't.

The point of VAT is that it should only apply to non-essential spending. Of course, it doesn't get it right all the time.. but it's not too bad. It's not on most food, books, children's clothes, public transport and other such things. Whether VAT is applied to the right things is a matter for another day, but it's irrelevant to the question of whether it is a fair tax.

Thursday, 8 March 2012

Caroline Flint is an idiot

She's an idiot.

A 2.5% VAT cut translates to a 2.1% reduction in the cost of something to which VAT is applied. So something which would have cost £120 (aka £100 plus 20% VAT) would now cost £117.50.nTherefore, to save £450 then someone would need to spend £21,600 (inclusive of 20% VAT).. with lower VAT they would pay £21,150. That's £1,800 per month.

To have £1,800 per month to spend, a household(1) needs a gross income in excess of £25k a year, or £480 per week. According to the IFS (see fig 2.1), median household income in the UK in 2009-10 was £413, and mean was £517.

So someone with an average income can, should they be so minded, save £450 in VAT. Just.

But, not really.... because this requires a household to spend every penny of that income on stuff to which VAT is added. So, well, that means they can't spend any money on, er, housing.. food.. children's clothes.. insurance.. utilities and whatever else various governments have decided should not attract VAT (or, in the case of utilities, standard rate VAT)

So let us be a little more realistic.. let us assume that our household spends £550 on housing (that'll get you a £100k mortgage), and £75 a week on food (according to the Guardian, £50 a week for a family of four is possible, but bloody tough). Now we need £2,650 a month if we're to save £450 from our VAT cut.. so we need a gross income of more like £40,000(2) a year... or £770 a week. Back to that IFS graph... we're now sitting pretty in the top 20%.

AND.. we're still expecting these people to live in modest homes (remember, we're only paying a £100k mortgage), have modest food bills, pay nothing in insurances, pay no utilities, pay no loans or finance costs, buy no children's clothes, put nothing into their pensions, and save nothing for a rainy day.

So, Caroline Flint, tell me again how cutting VAT by 2.5% will put £450 in the hands of ordinary families? Because I'm fortunate enough to sit pretty close to the sexy end of that graph, and I know damn well that I wouldn't save that much.

Curiously, do you know what WOULD put that sort of money into the hands of a lot of ordinary working people? Why, how about raising the personal allowance for income tax up to £10,000? Or even further.. up to the value of the minimum wage, where it should be anyway? Why doesn't Caroline Flint propose that instead? Perhaps because part of it is already coalition policy (and driven by those nasty LibDems, at that) and her party had many years in government during which they ratcheted up taxes on 'ordinary working people' whenever possible largely, a cynic might suggest, in order to fund a bureaucracy to find convoluted way to give some of it back.

(1) This assumes two earners who both pay basic rate tax. If income is biased towards one person then the gross amount needed increases because the tax paid will be higher. If there is only one earner then the figure is around £28,000 per year, or £540 per week.

(2) With a single earner the figures increases to £44,000 a year, or £846 a week. Now we're tickling the top 10% of households.