But, returning to Richard Murphy, unless someone turns up to do his job better than he does it, he's all there is.. and constantly poking him with a stick is achieving nothing. He's not going to change and, indeed, his 'popularity' is increasing and, he very much enjoys the sniping which simply reinforces his view that nothing worthwhile comes from those who would challenge him.

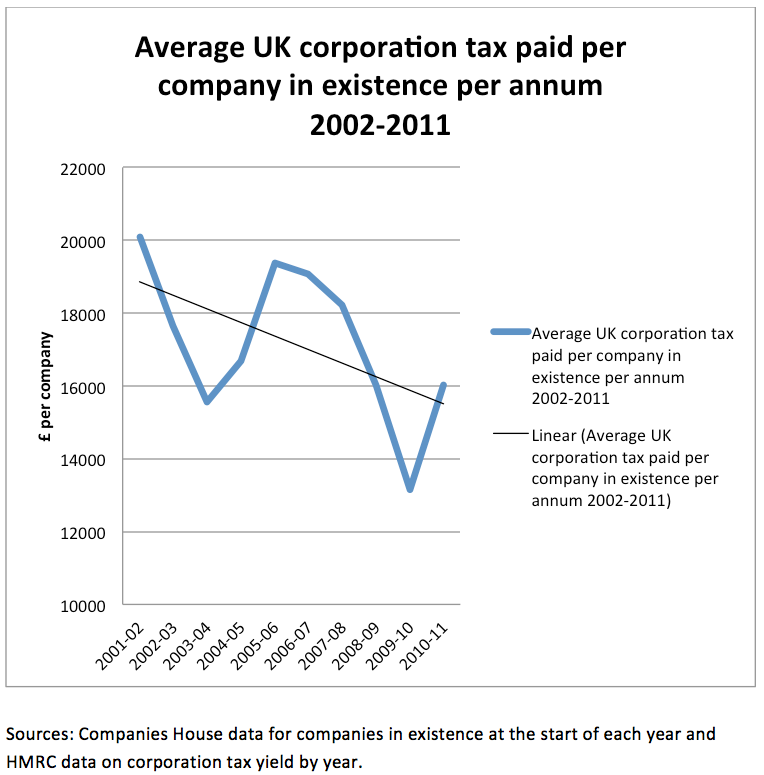

Today he asks us 'Why are companies paying less tax?', and shows us a graph which clearly illustrates that companies are, indeed, paying less tax..

Richard clearly explains what he has done.. he has taken the number of companies in the UK in each year, and the total corporation tax paid, and he's calculated the average paid per company. He's then drawn a line to show the trend.

Or, as the always well-informed Frances Coppola points out in the comments over in Timmyland..

He achieves this remarkable effect by drawing a straight line through two recessions (the second considerably deeper than the first) separated by a boom and followed by the current stagnation.In the comments on his post, Richard explains that there was a large rise in company numbers in 2004, and as he wanted to show a 'before/after' picture he started his line before that (as one of his commentators points out that starting the line in 2003/4 would have it trending upwards). I'm not quite sure why 2001/02 thus becomes the starting point. But let us not get too carried away over this sideshow..

Murhpy, eagerly pre-empting anyone who might wish to trouble him with a critical comment, quickly draws attention to an issue (my emphasis)..

It’s immediately possible to say that of course the amount of tax per company has gone down because the number of companies has gone up, but then so has to proportion of profits in GDP, so that doesn’t quite stack, but I agree I need to do more on that issue.Well, yes. You do. We have an increase of over 1 million companies during the period... or 62%. GDP rose by 42% over the same period, and we have an understanding that there was a spike in incorporations in 2004 due to a (subsequently withdrawn) tax 'fiasco'. That is a huge increase in company numbers, and to assume that the tax profile of those million companies which were added to the register during this period is comparable to that of the 1.6million companies on there at the start, which is what Murphy has done, is farcical... not because it's necessarily untrue (a cursory analysis of table T11.3 in HMRC's corporation tax statistics indicates that the percentage of corporate profits charged at the main and small company rates has not varied a great deal between 2002 and 2010) but because it's wildly premature.

Murphy is eager to point out that 'small companies do pay tax', and he's right... but they pay it at a materially lower rate. He charts a fall in average tax paid (either end of his trend line) from £19,000 to £15,800.. about 17%. The small company tax rate is 25% lower than the main company rate, so a shift in the profile will lower the average rate.

I decided to redraw the graph but adjusted to try and take out two distorting factors..

- A disproportionate growth in the number of companies (measured relative to GDP)

- The fall in the main company tax rate from 30% to 28%

So here's my graph and trendline (the red ones) on top of RM's (the blue ones). I've got the *real* average tax rising. So everything is fine and Richard Murphy is an idiot, yes?

Well, no.. because Richard has shown that you can prove anything by doing a little bit of research, making wild assumptions, and cherry picking what you present. I have proven that you can take data that has been abused to make one point and throw in a couple of plausible sounding assumptions which

make the data say the opposite. And I could easily go further. And I could easily convince anyone pre-disposed to my desired conclusion and lacking the ability/will to question it, that Murphy has no idea what he is talking about and should be forever ignored.

Murphy goes on to discuss his issue with the failure of 700,000 companies a year to submit their corporation tax return. He thinks that this covering up a significant amount of evasion, and that this is a key element of his much-quoted £120bn tax gap(1). I think that anyone who registers a company should comply with HMRC requests for information. If you wish to incorporate, and avail yourself of the legal protections is affords, then it's not a big ask. I think Murphy grossly overestimates the quantum of the tax loss, but that's something of an irrelevance because I agree that something should be done to deal with the problem. It is not acceptable that 30% of companies don't fulfil the modest obligations that parliament has imposed upon them.

And, so, therein lies my big problem.. he's got a point to make, and it's a point I'm happy to see made.. but I don't want to see it made with the aid of such a clumsy tool (I mean the graph, not Richard Murphy), because Murphy's audience will just take the tool and present it as further 'proof' that Phillip Green is the cause of all of our ills. Murphy knows this, he (I am sure) believes that having these misconceptions continually shouted from the rooftops (literally, on occasion) is a good thing, because the benefit of the PR outweighs the harm of an ill-informed populace looking for hate-targets.

I, respectfully, disagree.

(1) As an aside, but which fits with where I find my greatest frustration, Murphy has never suggested that this is something done by large companies and rich individuals.. because he knows that if there is a problem here, then it's the little guys. It's tax evasion, and people who can afford to minimise their tax legally will usually avoid minimising it illegally. However, his £120bn figure is usually attributed by others (UK Uncut, Union leaders etc etc) almost solely to big business and the 1%. I've never seen Murphy attempt to correct this obvious misreading of his own research, which bothers me because if he really wanted tax justice he would want a better understanding of the fact that evasion and avoidance is something which, whatever the quantum, pervades society. If Mark Serwotka, who made this error on Question Time last week really wants that whole £120bn collected, then he needs to be willing to tell the 99% that we, too, need to stump up our share.

Well, I agree with you. If he's got a point to make, then he needs to make it supported by evidence. And that evidence needs to be subject to scrutiny. Should any of it be found to be misrepresented or wrong, then he needs to accept that at least some of his points may end up falsified. It's his wilful refusal to accept that evidence-based method that I find so frustrating.

ReplyDeleteIt simply isn't good enough to argue, as he does, that there's tax evasion because he says there is, so it simply doesn't matter whether the evidence backs it up or not.

I don't know that I accept your interpretation of his £120bn estimate. Most profits are made by large companies; most tax is paid by large companies. So it stands to reason that the bulk of avoidance must be by larger taxpayers too, doesn't it? He is fairly loose in his definition of avoidance - he includes the use of legitimate reliefs, including double taxation relief - so it 's unsurprising that those with bigger profits would end up being the larger "avoiders" by this measure.

I base it on a few of things. Firstly, HMRC's own report on the tax gap illustrates their belief that it is spread across income groups. Secondly, things like the 'missing' returns from companies are, he accepts, not the responsibility of the rich. Lastly, he's been known to acknowledge that it's a wide problem.

DeleteMost corporation tax is, of course, paid by big companies (76% of taxed corporate profits are, at the very least, at the main rate) but his research leads him to believe that small companies should be paying a lot more. Further, the tax gap includes VAT avoidance, the black economy, duty evasion (dodgy cigs etc) and these are not things that big companies are involved in.. there are big sums being evaded thanks to thousands/millions of people doing all those little things that keep a few quid away from the treasury.

The big avoiders avoid the big bucks, but there aren't all that many of them and, as you yourself have consistently illustrated, the anti-avoidance movement has consistently failed to find good examples of major corporate avoidance. (That isn't to say, of course, that a company needs to actually be a major avoider to get rolled into RM's calculations.)

He doesn't, obviously, take this as evidence of the fact that it's not just puppy-torturing tories who think that the tax burden is too high.

I'm still at a loss as to why he included number of companies, other than to promote a false premise.

ReplyDeleteThe base corp tax figures below show a gradual increase, as one would expect taking into account recession etc, its only a small data set but it has an 88% correlation bit income tax receipts.

Year Tax

2001-02 32,041

2002-03 29,268

2003-04 28,077

2004-05 33,641

2005-06 41,829

2006-07 44,308

2007-08 46,383

2008-09 43,077

2009-10 35,805

2010-11 42,121

2011-12 43,721 (provisional)

It's his obsession with all these companies who don't submit returns and the vast ocean of avoidance that he feels that is concealing. I suspect that it's mainly concealing a bunch of pointless paperwork, but we should try and clear it up and if he's right then good for him.. I won't weep for people who are not declaring business profits.

DeleteBut, having decided that the number of companies is important.. it's merely a case of shoehorning it into a dataset to try and promote his premise with, at best, a flagrant disregard for whether it's false or not.

At the root of his argument, it would appear, is a belief that every company registered in a year should be paying £20k of tax by the end of it. I know he's a fan of abusing data, but this one was especially crass even by his own standards.

How many of these thousands of companies not filling out tax returns to HMRC are:

Delete1) Defunct/non-trading private service companies set up by freelancing individuals. Ten years ago freelance consultants/pundits were far thinner on the ground. These days every early retired professional who does a bit of consultancy/media work sets up a PSC and then forgets about it. How many PSCs has Ken Livingstone to his name still extant but non-trading.

2) Tenants in blocks of flats who have bought freehold and set up company to manage the building. I know from personal experience that these are often years behind in returning reports to Companies House.

Shinsei... I suspect the answer is 'an awful lot', which is why Richie won't find the level of tax evasion in those companies that he thinks he will. Call me crazy, but I think that anyone who wants to trade without declaring profits is unlikely to do so through a limited company.

DeleteI'm all for a housekeeping exercise, however, whereby we chase up these people and get defunct ones formally struck off, and fund out what's stopping the others from doing their paperwork.